Top 10 Most Powerful Mirror Trading Platform for Passive Profits

In a world where financial freedom increasingly depends on automation and smart investing, the demand for “Mirror Trading Platform” solutions has surged. These platforms allow investors—novices and pros alike—to mirror the trades of successful traders, creating a pathway to passive profits. But not all platforms are created equal. Some offer superior transparency and performance, while others lack the infrastructure to protect your capital.

In this guide, we’ve reviewed the top 10 most powerful Mirror Trading Platforms in 2025, dissecting their features, use cases, strengths and weaknesses, and affiliate programs. Whether you’re looking for crypto-based copy trading or forex signal replication, this list will help you make an informed decision.

Let’s dive into the most reliable and profit-driven platforms for mirror trading.

Discover the 10 Most Powerful Mirror Trading Platforms for Passive Profits

Explore the best mirror trading platforms trusted by top traders — automate your strategy, copy the pros, and earn passive profits effortlessly.

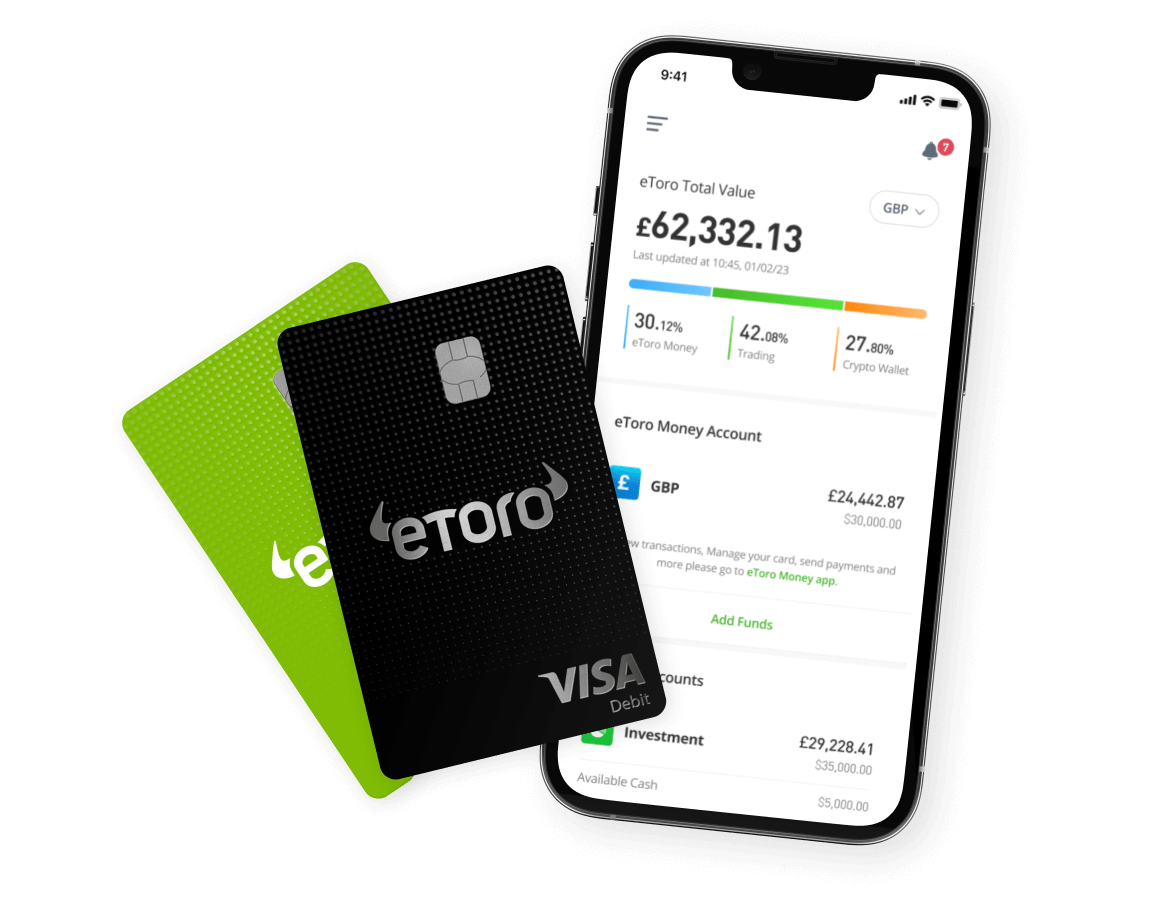

1. eToro

Platform Overview

eToro stands as one of the most established and globally recognized names in the Mirror Trading Platform industry. It popularized the concept of “social trading”—a form of automated trading where users can replicate the strategies of top-performing traders with the click of a button. Regulated across multiple jurisdictions, eToro’s easy-to-use interface and transparency have helped millions access passive income through mirror trading.

Key Features

- CopyTrader System: Users can mirror the entire portfolio of successful traders in real time.

- Social Trading Feed: Communicate and learn directly from trading veterans.

- Regulated & Secure: FCA (UK), ASIC (Australia), CySEC (EU).

- Multi-Asset Support: Crypto, stocks, forex, ETFs—all in one Mirror Trading Platform.

Advantages

- Beginner-friendly interface

- Transparent trader stats and risk scores

- Community-driven learning

- Advanced filtering for strategy selection

Drawbacks

- Limited custom automation tools

- Spread fees can be higher than other platforms

Affiliate Program Analysis

- Commission: Up to $250 per qualified trader + revenue share

- Allowed Countries: 100+ countries (excluding US for crypto)

- Payment Gateway: Bank transfer, PayPal, Crypto

- Cookie Duration: 30–45 days

- KYC Required: Yes

Comparison to Other Platforms

While eToro may lack the deep custom strategy design found in platforms like Cryptohopper, it remains the most intuitive Mirror Trading Platform for beginners. Its rich trader database and educational resources make it more interactive than passive bots like QuantVPS.

2. ZuluTrade

Platform Overview

ZuluTrade is one of the original forex-based Mirror Trading Platforms and has since expanded into crypto, indices, and commodities. With a strong emphasis on risk management and trader verification, ZuluTrade enables users to automatically follow the trades of vetted professionals and profit passively through automation.

Key Features

- ZuluRank Algorithm: Rates traders based on performance, risk, and behavior.

- Risk Management Suite: Includes ZuluGuard to protect against erratic trades.

- Multi-Broker Integration: Connects to brokers like IC Markets, FXCM, and more.

- Cross-Asset Coverage: Forex, crypto, indices, and CFDs.

Advantages

- Detailed trader analytics and risk scores

- Integrates with over 60 brokers

- Suitable for both retail and institutional clients

Drawbacks

- Some features locked behind broker-specific tiers

- Interface can feel outdated compared to newer Mirror Trading Platforms

Affiliate Program Analysis

- Commission: Revenue share up to 30%

- Allowed Countries: Global

- Payment Gateway: Bank transfer, Skrill, Crypto

- Cookie Duration: 30 days

- KYC Required: Yes

Comparison to Other Platforms

ZuluTrade stands out as a hybrid Mirror Trading Platform combining traditional forex and modern crypto strategies. Compared to eToro, it offers deeper analytics but lacks social features. Against newer platforms like WunderTrading, it holds a legacy advantage but could use a UX upgrade.

3. Bybit

Platform Overview

Bybit is widely recognized for its deep liquidity and user-friendly derivatives trading. Recently, it has stepped into the Mirror Trading Platform space by enabling users to follow top crypto traders through its “Copy Trading” feature.

Key Features

- USDT-M and Coin-M Copy Trading: Trade derivatives by mirroring experts.

- Top Traders Leaderboard: Detailed PnL stats, risk profiles, and ROI over time.

- Integrated Wallet Security: Funds remain on the platform, reducing transfer risks.

Advantages

- High liquidity and fast order execution

- Transparent trader performance tracking

- No additional fees for copy trading

Drawbacks

- Limited to derivatives trading

- Lacks long-term portfolio strategies

Affiliate Program Analysis

- Commission: Up to 30% lifetime trading fees

- Allowed Countries: Global (restrictions in US)

- Payment Gateway: Crypto

- Cookie Duration: 30 days

- KYC Required: Yes

Comparison

Bybit is ideal for short-term crypto traders seeking a fast-paced Mirror Trading Platform. Compared to eToro, it lacks multi-asset support but excels in real-time derivatives replication.

4. Binance

Platform Overview

Binance, the world’s largest cryptocurrency exchange, has rolled out its own Mirror Trading Platform capabilities via Binance Copy Trading. Though still in beta, the feature integrates seamlessly into Binance’s trading environment, allowing users to mirror trades of high-performing traders.

Key Features

- Copy Trading via Spot and Futures: Includes top trader rankings.

- Integrated Binance Wallets: No third-party transfers required.

- High-Speed Execution: Capitalizes on Binance’s deep liquidity.

Advantages

- World-class exchange reputation

- Institutional-grade performance metrics

- Constant updates and ecosystem integration

Drawbacks

- Limited to Binance ecosystem

- Still in beta, with feature rollouts pending

Affiliate Program Analysis

- Commission: 20–40% referral bonus

- Allowed Countries: Global (with country-specific exclusions)

- Payment Gateway: Crypto payouts

- Cookie Duration: 30 days

- KYC Required: Yes

Comparison

Binance offers unmatched liquidity and infrastructure for a Mirror Trading Platform. However, it’s less mature in mirror trading features compared to dedicated platforms like eToro or ZuluTrade.

5. MEXC

Platform Overview

MEXC Global has recently surged in popularity due to its advanced trading features and lower fees. Its Mirror Trading Platform supports copy trading across spot and futures, targeting both new users and experienced traders.

Key Features

- Copy Trading Leaderboard: Easy-to-follow ranking of top traders

- Advanced Order Types: For mirrored and manual trading

- No KYC Entry (optional): At basic levels

Advantages

- High APY staking plus copy trading

- Low fees and slippage

Drawbacks

- Interface less polished than larger exchanges

Affiliate Program Analysis

- Commission: Up to 50% trading fees

- Allowed Countries: Global

- Payment Gateway: USDT, BTC

- Cookie Duration: 30 days

- KYC Required: No (for affiliates)

Comparison

MEXC’s Mirror Trading Platform competes well on commission and ease of access, ideal for crypto traders who want a lower-barrier alternative to Binance or Bybit.

6. Bitget

Platform Overview

Bitget has earned credibility in derivatives and now offers one of the most robust Mirror Trading Platforms for crypto. It allows users to follow elite traders across spot, futures, and options.

Key Features

- Elite Trader Ranking System: Performance metrics, trade frequency, and win rate

- Auto Profit-Sharing: Earn as you follow

- Futures and Options: Great for advanced strategies

Advantages

- High-end trader transparency

- Secure and fast copy execution

Drawbacks

- Primarily focused on advanced users

Affiliate Program Analysis

- Commission: Up to 50% of user trading fees

- Allowed Countries: Global

- Payment Gateway: Crypto

- Cookie Duration: 30 days

- KYC Required: Yes

Comparison

For serious traders, Bitget’s Mirror Trading Platform is a go-to choice. While it doesn’t have eToro’s social aspects, it’s ideal for performance-driven strategies.

7. Phemex

Platform Overview

Phemex has simplified access to the Mirror Trading Platform world by making it beginner-friendly. The platform supports spot and futures copy trading and is known for its fast onboarding.

Key Features

- Fast Registration & Copy Setup

- Strategy Center: Predefined strategies for different risk levels

Advantages

- No-frills copy trading

- Smooth mobile experience

Drawbacks

- Limited trader pool

- Fewer analytics features

Affiliate Program Analysis

- Commission: Up to 50% fees

- Allowed Countries: Global

- Payment Gateway: Crypto

- Cookie Duration: 30 days

- KYC Required: Optional

Comparison

Phemex stands between MEXC and Bitget in its Mirror Trading Platform offerings, balancing ease of use with solid features.

8. WunderTrading

Platform Overview

WunderTrading specializes in smart mirror trading with extensive customization. Built for advanced users, the platform lets users automate strategies and mirror trades from TradingView scripts.

Key Features

- Smart Bots + Mirror Trading

- TradingView Integration

- Multiple Exchange API Support

Advantages

- High automation flexibility

- Trading strategy builder

Drawbacks

- Learning curve for new users

Affiliate Program Analysis

- Commission: 30% per subscription

- Allowed Countries: Global

- Payment Gateway: Crypto, Card

- Cookie Duration: 90 days

- KYC Required: No

Comparison

WunderTrading is ideal for tech-savvy traders wanting programmable Mirror Trading Platforms. More advanced than eToro, but less accessible to beginners.

9. Cryptohopper

Platform Overview

Cryptohopper combines mirror trading, bots, and technical indicators for a full-spectrum trading assistant. Users can browse a strategy marketplace or subscribe to top-performing traders.

Key Features

- Strategy Marketplace

- Social and Copy Trading

- Simulated Paper Trading

Advantages

- Diverse tools in one platform

- Active community and tutorials

Drawbacks

- Requires subscription for full features

Affiliate Program Analysis

- Commission: 15–30% recurring

- Allowed Countries: Global

- Payment Gateway: Crypto, PayPal

- Cookie Duration: 30 days

- KYC Required: No

Comparison

Cryptohopper offers more customization than eToro but less simplicity. Ideal for experimental and semi-pro users of Mirror Trading Platforms.

10. QuantVPS

Platform Overview

QuantVPS focuses on speed and accuracy in copy trading, especially for forex and algorithmic traders. It supports VPS-based signal mirroring and low-latency execution.

Key Features

- Low-Latency Trading

- Custom VPS Deployment

- Signal API Integration

Advantages

- Designed for institutional or high-frequency traders

- Extreme precision in signal replication

Drawbacks

- Requires external broker and VPS setup

- Not for beginners

Affiliate Program Analysis

- Commission: 10–20% per sale

- Allowed Countries: Global

- Payment Gateway: Crypto, PayPal

- Cookie Duration: 60 days

- KYC Required: No

Comparison

QuantVPS is a niche Mirror Trading Platform suited for pro traders needing fine control. Compared to eToro, it’s far more technical and precise.

Comparison Table – Platform Overview

| Platform | Asset Types | Best For | Customization | KYC |

|---|---|---|---|---|

| eToro | Multi-Asset | Beginners | Low | Yes |

| ZuluTrade | Forex, Crypto | Analytics-Driven Traders | Medium | Yes |

| Bybit | Crypto Derivatives | Short-Term Crypto Traders | Medium | Yes |

| Binance | Crypto | Ecosystem Traders | Medium | Yes |

| MEXC | Crypto | Low-Fee Traders | Medium | No |

| Bitget | Crypto | Pro Copy Traders | High | Yes |

| Phemex | Crypto | Mobile-Friendly Users | Medium | Optional |

| WunderTrading | Multi-Exchange | Programmers | High | No |

| Cryptohopper | Multi-Exchange | Semi-Pro Traders | High | No |

| QuantVPS | Forex, Crypto | Institutional Clients | Very High | No |

Affiliate Program Comparison

| Platform | Commission | Cookie Duration | KYC | Payment Methods |

| eToro | Up to $250 | 30–45 days | Yes | Bank, Crypto |

| ZuluTrade | Up to 30% | 30 days | Yes | Crypto, Bank |

| Bybit | Up to 30% | 30 days | Yes | Crypto |

| Binance | 20–40% | 30 days | Yes | Crypto |

| MEXC | Up to 50% | 30 days | No | Crypto |

| Bitget | Up to 50% | 30 days | Yes | Crypto |

| Phemex | Up to 50% | 30 days | Optional | Crypto |

| WunderTrading | 30% | 90 days | No | Crypto, Card |

| Cryptohopper | 15–30% | 30 days | No | Crypto, PayPal |

| QuantVPS | 10–20% | 60 days | No | Crypto, PayPal |

Choose the Mirror Trading Platform that matches your style and start your passive trading journey today!

Final Thoughts

With so many mirror trading platforms available, it’s essential to choose one that aligns with your financial goals, technical comfort, and risk tolerance. By analyzing each Mirror Trading Platform through experience-backed research and transparent criteria, we aim to empower your passive investing journey.

Stay tuned as we break down each platform in the sections that follow.