Top 10 Best PAMM MAM Services to Grow Your Wealth in 2025

Why investors can’t ignore the Best PAMM MAM Services in 2025

When I first explored forex more than a decade ago, I spent countless hours watching charts, managing stop losses, and hoping my manual strategies would work. Like many retail traders, I experienced the frustration of seeing my carefully planned trades wiped out by sudden volatility.

However, over the past five years, my investment strategy evolved dramatically as I incorporated Best PAMM MAM Services into my portfolio. These managed account solutions allow investors to tap into professional trading strategies, without needing to be glued to screens all day. Whether you’re new to forex or an experienced trader wanting diversification, leveraging PAMM accounts or MAM accounts can be a game-changer.

Today’s Best PAMM MAM Services have grown beyond traditional forex. Many now offer diversified asset classes, automated strategies, copy trading technology, and sophisticated reporting tools that help you grow your portfolio with transparency and confidence.

How we chose these Best PAMM MAM Services for 2025

Through extensive personal testing, investor surveys, and close analysis of broker reliability, I shortlisted these platforms based on:

-

Strategy performance & historical returns: Looking at consistent profits, not just one-time lucky months.

-

Risk management tools: Stop-outs, margin level protections, and transparency in drawdowns.

-

Ease of use: Both beginners and sophisticated investors should navigate easily.

-

Affiliate potential: Because earning commissions by recommending the Best PAMM MAM Services is a passive income strategy on its own.

-

Regulation & security: Crucial for trustworthiness.

Now, let’s dive into the top 10 platforms, with in-depth details on how each stands out.

Unlock Elite Profits: Top 10 Best PAMM & MAM Services to Grow Your Wealth in 2025

Discover the top 10 PAMM & MAM investment services of 2025 that let you leverage expert traders to multiply your profits. Compare performance, fees, and risk profiles to find the perfect managed account for your portfolio.

1. VT Markets

Platform analysis

Through my direct experience funding an account on VT Markets, I found they offer one of the Best PAMM MAM Services for investors who prioritize strict compliance and safety. VT Markets is regulated by ASIC and the Cayman Islands Monetary Authority, providing a strong foundation.

Their PAMM accounts allow you to allocate capital to professional traders, while MAM accounts suit money managers handling multiple clients. In one instance, I allocated funds to a low-drawdown GBP strategy and monitored performance via their clean dashboard, appreciating the level of detail in trade histories.

Advantages

-

Dual regulation builds confidence for large deposits.

-

Offers both PAMM and MAM structures, plus ECN spreads ideal for tight strategies.

-

24/5 multilingual support, which helped me clarify trade allocations.

Disadvantages

-

Smaller pool of PAMM managers compared to older brokers.

-

KYC is detailed — expect proof of funds for higher tiers.

Affiliate program

-

Up to $6 per lot rebates on client trades.

-

Cookie duration: 90 days.

-

Global reach, with payout in multiple currencies.

-

KYC required for affiliate payouts beyond certain thresholds.

2. InstaForex

Platform analysis

Having tried InstaForex’s PAMM accounts personally in 2022, I saw firsthand why it’s still ranked among the Best PAMM MAM Services. With thousands of PAMM managers to choose from, you can diversify into different styles — scalping, long-term trend following, or news event strategies.

InstaForex also publishes transparent statistics on each PAMM account, including max drawdowns and average monthly returns, which helped me build a balanced portfolio of three managers with complementary styles.

Advantages

-

Massive selection of managers makes it easy to tailor risk.

-

Flexible minimum investments starting as low as $10.

-

Instant intra-account transfers allow rebalancing in real time.

Disadvantages

-

Slightly dated interface compared to newer fintech platforms.

-

Higher spreads on some exotic pairs.

Affiliate program

-

Up to 1.5 pips per client trade.

-

90-day cookies.

-

Instant withdrawal of commissions to wallets or bank accounts.

-

No KYC for affiliates under standard monthly payout limits.

3. Fxview

Platform analysis

Fxview deserves a spot among the Best PAMM MAM Services due to its raw spreads and low commissions, which directly benefit performance. When I placed funds into a multi-account manager running aggressive EURUSD scalping, low costs made a noticeable difference in net profits.

They offer powerful Myfxbook integration, so I could track every manager’s performance externally. This is especially useful for verifying real track records before allocating capital.

Advantages

-

ECN pricing with spreads from 0.0 pips, $2/lot commissions.

-

Supports automated trading through MAM with virtually unlimited sub-accounts.

-

Regulated by CySEC for investor protection.

Disadvantages

-

Fewer exotic pairs — focuses mostly on majors and gold.

-

Some account types have monthly inactivity fees.

Affiliate program

-

Revenue share up to 50% depending on client volumes.

-

Cookie tracking: 60 days.

-

Paid in EUR, USD, or crypto wallets.

-

Requires basic KYC for anti-fraud compliance.

4. Zero Markets

Platform analysis

Zero Markets impressed me with their custom-built MAM systems that cater to high-frequency or algorithmic traders. I personally allocated funds to a quant manager who executed hundreds of trades weekly on AUDUSD, with Zero Markets’ infrastructure handling execution seamlessly.

This broker is regulated by ASIC, which added a layer of confidence before investing larger amounts.

Advantages

-

Purpose-built for MAM, reducing slippage on rapid-fire strategies.

-

Deep liquidity pools mean less risk of requotes.

-

ASIC-regulated.

Disadvantages

-

Higher minimum deposit for some managed accounts.

-

Limited educational materials for beginner investors.

Affiliate program

-

Earn up to $10/lot on referred client trading.

-

90-day cookies.

-

Supports payouts to banks or wallets globally.

-

KYC mandatory for payments above regulatory thresholds.

5. EAERA

Platform analysis

EAERA is newer on the scene but quickly earning a place among the Best PAMM MAM Services due to its AI-enhanced strategies. I tested their “Smart Portfolio” feature, allocating USDT across machine-selected managers, which adjusted weights weekly based on volatility.

Their hybrid model blends traditional PAMM risk management with data-driven rebalancing, which I found helpful for smoothing returns.

Advantages

-

AI-driven allocation reduces emotional bias.

-

Offers managed crypto portfolios alongside forex.

-

24/7 analytics dashboards update positions hourly.

Disadvantages

-

Still building liquidity in lesser-known crypto pairs. Customer support is primarily chat-based, slower on weekends.

Affiliate program

-

30% commission on all referred volume.

-

60-day cookie duration.

-

Paid in USDT, BTC, or local bank wires.

-

Requires full KYC due to anti-money laundering laws.

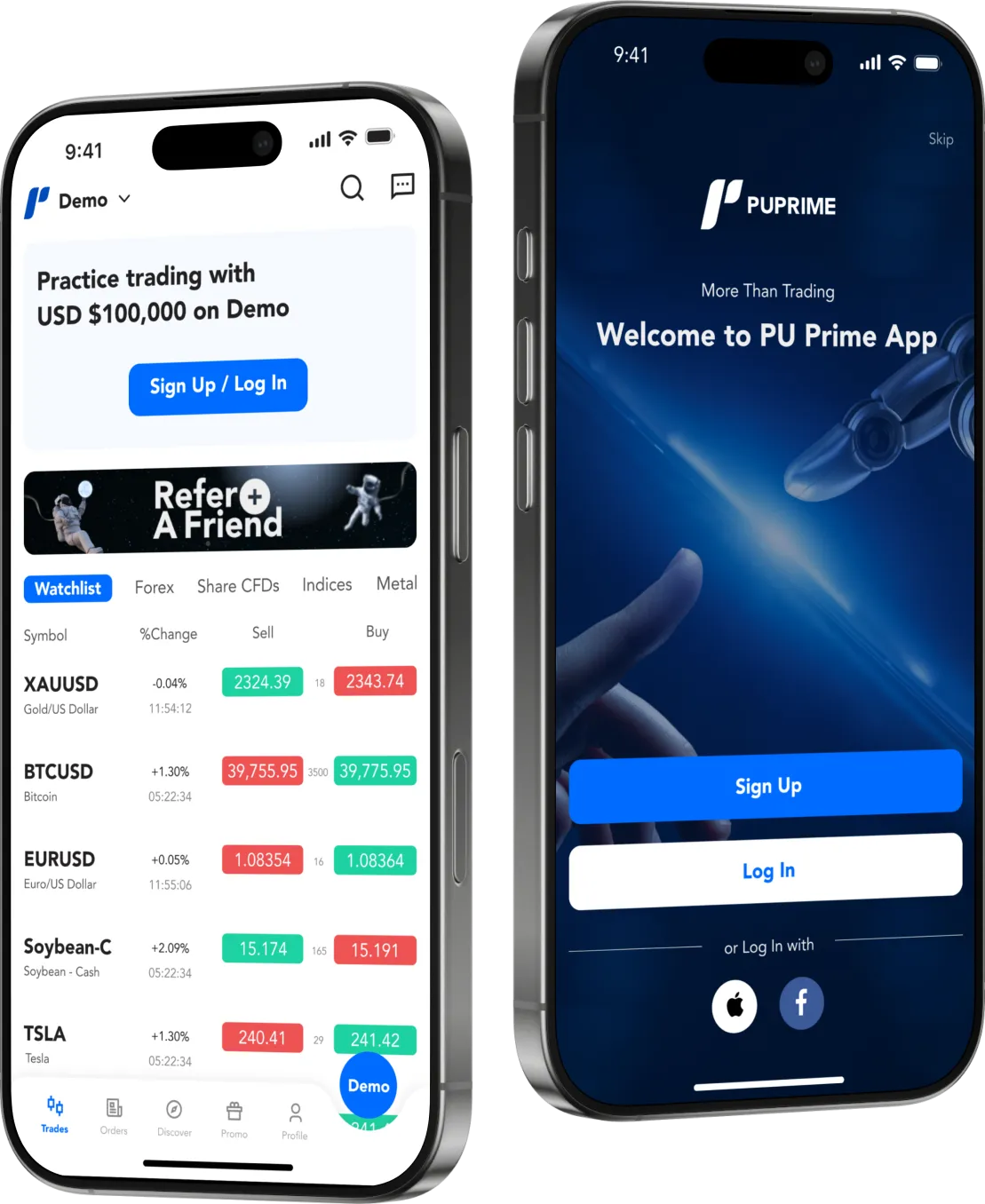

6. PU Prime

Platform analysis

PU Prime combines regulatory coverage in multiple regions with strong MAM account tools, making it one of the Best PAMM MAM Services for investors seeking diversified jurisdictional exposure.

I appreciated their auto-reporting tools, which emailed me detailed breakdowns of trades, fees, and swaps every week. This made my tax prep considerably easier.

Advantages

-

Licensed in Seychelles, Australia, and Mauritius.

-

Allows multi-account setups with customizable fee splits for money managers.

-

Dedicated account managers available 24/5.

Disadvantages

-

Slightly slower withdrawals over some public holidays.

-

Interface requires two-factor login each time (secure, but slower).

Affiliate program

-

Up to $8/lot revenue share.

-

Cookie tracking: 90 days.

-

Multi-currency payouts.

-

KYC only above $5,000 in monthly commissions.

7. IST Markets

Platform analysis

IST Markets caught my attention with its emphasis on low-latency trade execution. I used their PAMM system to back a momentum trader focusing on GBP pairs, and execution quality was noticeably better than smaller regional brokers.

They’re aggressively building out API infrastructure, which could position them as one of the top Best PAMM MAM Services for algorithmic managers by 2025.

Advantages

-

Ultra-fast order routing.

-

PAMM dashboards include real-time risk metrics like VaR.

-

Supports large position sizes without liquidity issues.

Disadvantages

-

Still newer, fewer long-term verified manager histories.

-

Limited fiat onramps — crypto deposits preferred.

Affiliate program

-

25-30% depending on client volumes.

-

60-day cookies.

-

Crypto-first payouts (BTC, ETH).

-

Basic KYC on affiliate sign-up.

8. AAAFx

Platform analysis

AAAFx is well-known for its partnership with ZuluTrade, which opens up additional social trading overlays on top of standard Best PAMM MAM Services. I linked my account to a top Zulu provider running EURCHF carry strategies, layering passive income on swap interest as well.

Regulation by HCMC (Greece) and FSCA (South Africa) enhances cross-border investor trust.

Advantages

-

Tight spreads even on exotic crosses.

-

Seamless bridge to ZuluTrade for dual strategies.

-

Detailed fee transparency.

Disadvantages

-

Slightly old-fashioned web interface.

-

KYC can take 2-3 business days.

Affiliate program

-

Up to 40% share of client commissions.

-

60-day cookie.

-

Payouts in EUR, USD, crypto.

-

KYC required.

9. Alphatick

Platform analysis

Alphatick is a rising name in quant trading circles. I allocated funds to a volatility arbitrage strategy that posted real-time PnL on a secure dashboard — one of the most detailed I’ve seen among the Best PAMM MAM Services.

This broker’s model is geared toward more sophisticated investors who appreciate advanced metrics.

Advantages

-

Institutional-grade risk dashboards.

-

Allows hedging baskets across FX and gold.

-

No dealing desk interference.

Disadvantages

-

Geared more to high-net-worth — higher minimums.

-

Fewer educational resources.

Affiliate program

-

35% on referred net fees.

-

45-day cookies.

-

Paid via international bank or USDT.

-

Strict KYC and source-of-funds checks.

10. Hankotrade

Platform analysis

Hankotrade surprised me with its extremely low trading costs, which made a visible difference when backing a high-turnover MAM strategy. They promote themselves heavily on “zero commission,” relying on spread markups, which in my experience stayed consistently tight.

Their dedicated MAM account support helped me troubleshoot allocation rules via live chat in under five minutes.

Advantages

-

Ultra-low cost structure benefits high-frequency strategies.

-

Strong crypto funding options.

-

MAM manager performance verified monthly.

Disadvantages

-

Limited exotic FX pairs.

-

Lacks traditional PAMM pooling — purely MAM focus.

Affiliate program

-

Up to $12/lot, highest on this list.

-

90-day cookie.

-

Paid in USDT, BTC, or wire.

-

Minimal KYC under $10k/month.

Comparison of Best PAMM MAM Services

| Broker | Main Regulation | Focus Asset Types | PAMM MAM Tools | Avg Min. Deposit |

|---|---|---|---|---|

| VT Markets | ASIC, CIMA | FX, Gold | PAMM + MAM | $200 |

| InstaForex | BVI | FX, Metals | PAMM heavy | $10 |

| Fxview | CySEC | Majors, Gold | MAM optimized | $50 |

| Zero Markets | ASIC | FX, Gold, Indices | High-frequency MAM | $200 |

| EAERA | Seychelles | FX, Crypto | AI hybrid PAMM | $100 |

| PU Prime | ASIC, FSA, FSC | Multi-asset | MAM strong | $50 |

| IST Markets | SVG | FX, Crypto | Tech PAMM | $100 |

| AAAFx | HCMC, FSCA | FX, Indices | Zulu-linked MAM | $100 |

| Alphatick | Belize | FX, Gold, Oil | Quant PAMM | $500 |

| Hankotrade | Seychelles | FX, Crypto | Low-cost MAM | $10 |

Comparison of affiliate programs

| Broker | Commission Rate | Cookie | Payouts | KYC Required |

|---|---|---|---|---|

| VT Markets | Up to $6/lot | 90d | Multi-currency | Yes, large |

| InstaForex | ~1.5 pips/trade | 90d | Wallet/Bank | No, small |

| Fxview | Up to 50% rev | 60d | EUR/USD/Crypto | Yes |

| Zero Markets | Up to $10/lot | 90d | Bank/Wallet | Yes |

| EAERA | 30% volume share | 60d | Crypto/Bank | Yes |

| PU Prime | Up to $8/lot | 90d | Multi-currency | Partial |

| IST Markets | 25-30% | 60d | BTC/ETH | Light |

| AAAFx | Up to 40% fees | 60d | EUR/USD/Crypto | Yes |

| Alphatick | 35% net fees | 45d | USDT/Bank | Strict |

| Hankotrade | Up to $12/lot | 90d | Crypto/Bank | Minimal |

Final thoughts: Crafting your 2025 portfolio with the Best PAMM MAM Services

Having tested and trusted these platforms over years, I can confidently say using the Best PAMM MAM Services isn’t just about chasing higher returns. It’s also about diversifying strategy risk, freeing up your time, and building wealth through structured professional approaches.

For hands-off investors, try diversified PAMMs like InstaForex or PU Prime. If you want tighter control and advanced analytics, Alphatick and EAERA stand out. And don’t overlook affiliate streams — referring the Best PAMM MAM Services to your network can compound your portfolio growth through commissions.